And in all beginnings indwells a magic

In the 90s, as the old world was first slowly, then rapidly, making way for the new age, technologists, activists, policy makers, and even philosophers knew that as the internet grew—and with it the fraction of our lives that we spend online—the ability of governments and corporations to construct the ultimate panopticon would become one of the biggest threats to modern society. They were right about that.

As more and more electronic devices and the internet penetrated our lives, from our homes and offices, to transmitting our phone calls and love letters, to the news we consume, and the products we order and pay for, our dependence on digital intermediaries that provide these services to us also increased. We started leaving marks and traces of our private lives everywhere we go, every day, doing almost everything we do.

Privacy advocates of the 90s knew what was coming. So did famous cryptographer David Chaum. Chaum is a world-renowned scientist with seminal contributions to the field of cryptography. He is most famous for conceiving the idea of electronic cash, or Ecash. David Chaum knew that as an ever-growing part of our lives would happen online, so would our commerce be fully digital one day. Equipped with his genius for cryptography, he invented a digital payment system that allowed its users to make purchases online without infringing on their privacy. The need for privacy for personal transactions was neither radical nor foreign to a society whose primary form of trade still relied on physical cash.

To understand how this system was designed, imagine a bank account with an ATM. The ATM allows you to withdraw physical paper cash from your bank account, which is basically an Excel sheet held at the bank with your account activity. When you go to an ATM, the machine spits out cash, and your bank account's balance is reduced by the amount you withdrew.

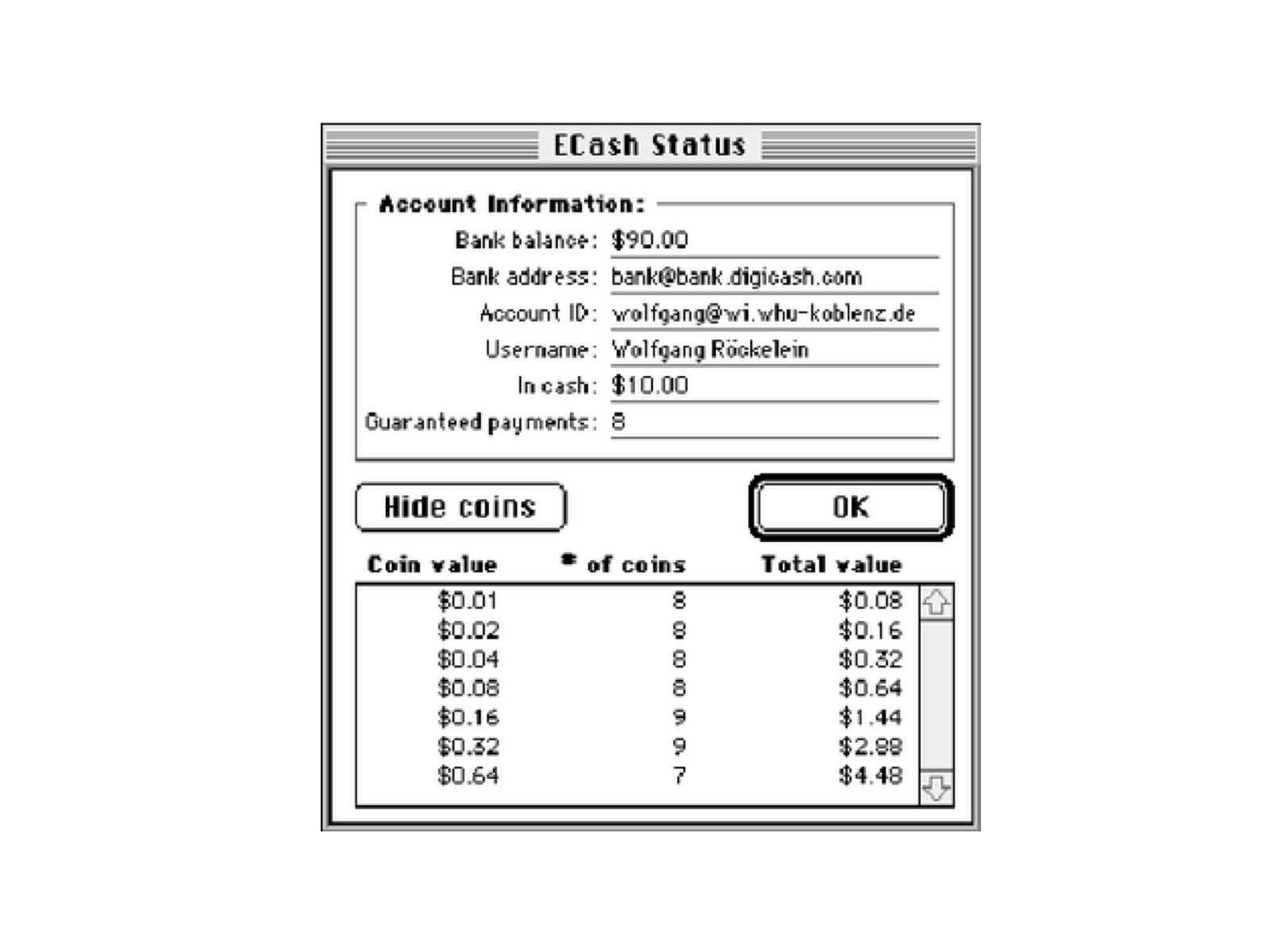

Chaumian Ecash worked the same way, but with digital cash. Users would log in to their internet bank accounts and press a withdraw button. Instead of receiving paper money though, they would receive a piece of digital data that had the same properties of paper money: a bearer asset that represents monetary value and can be privately and securely transferred from one person to another as a form of payment.

Ecash would be stored in a wallet application running on a user's computer and when they wanted to purchase goods online, they would send the Ecash directly to the merchant, like taking out bills from their physical wallet and handing them to the merchant in a physical store. Later, merchants would take the accumulated Ecash back to the bank and have it deposited to their bank account.

This is how it was supposed to be. Everyone loved it. In fact, they loved it so much, that Microsoft, Citibank, Credit Suisse, Deutsche Bank, Mastercard, and other huge entities wanted a piece of it. Remember, this is still the early 90s. The world didn't run on credit cards yet and online payment systems didn't exist on any meaningful scale yet.

The world was supposed to run on Chaumian Ecash. But it never did. Quo vadis, Ecash?

A very interesting historical account of this period is given in the article How DigiCash Blew Everything (Archive) written by a former employee of Chaum's company, or in this Genesis Files article and the Genesis Book by Aaron Van Wirdum. Although the reason for DigiCash's failure is not completely clear, most explanations point towards David Chaum's inability to reach a reasonable deal with these companies. In hindsight, this seems like a missed opportunity of epic proportions, given that massive financial entities showed interest in privacy-preserving technology, and even Microsoft offered to include a DigiCash wallet in every Windows 95 copy.

David Chaum could have ushered in a new era of digital money and privacy. But he failed. Instead, big financial corporations that once thought that financial privacy on the internet would become the norm lost their interest in this technology altogether and went for the next best thing: normal transparent ledger accounting, that is, Excel sheets without any of the user-empowering cryptography.

What we got instead of magic internet money was credit cards, PayPal, and online banking based on a ledger technology that is probably older than written language.

Here comes Bitcoin

While David Chaum's company struggled and failed to gain a footing, cryptographers around the world were deeply inspired by the concept of electronic cash. Chaum's invention of blind signatures kicked off more than two decades' worth of research on how digital money can be improved. A quick Google Scholar search reveals over 5,700 academic research papers for the search term "ecash".

Until now, we have avoided mentioning the biggest issue with digital cash systems as they were envisioned by Chaum's Ecash and his successors. That is, they all relied on a trusted centralized entity to work properly and to prevent monetary inflation.

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.

– Satoshi Nakamoto, 2009 (Source)

Satoshi Nakamoto invented Bitcoin, the first fully-decentralized peer-to-peer digital currency that did not rely on a centralized entity, neither to process transactions, nor to prevent inflation. With Bitcoin the network (capital B), Satoshi also invented bitcoin the currency (lower-case b). Since this new virtual form of money could not be coupled to anything external, it needed its own unit of account.

This too was a significant difference from previous Ecash designs that were meant to interoperate with an existing currency such as the US Dollar and existing financial networks, such as the banking system. Bitcoin didn't need any of that. It didn't want anything to do with it.

The Second Renaissance of Ecash

Bitcoin has established itself as the native online currency of the internet. Bitcoin is truly decentralized and its use is sovereign: users can hold their own keys and do not have to interact with any third party in order to make use of the network. However, the last decade has shown that the decentralization that Bitcoin upholds as its core principle comes with a price. That price is a constant battle between scaling, fees, and decentralization. Whenever a compromise between these was necessary, the Bitcoin network has always chosen decentralization, and rightfully so.

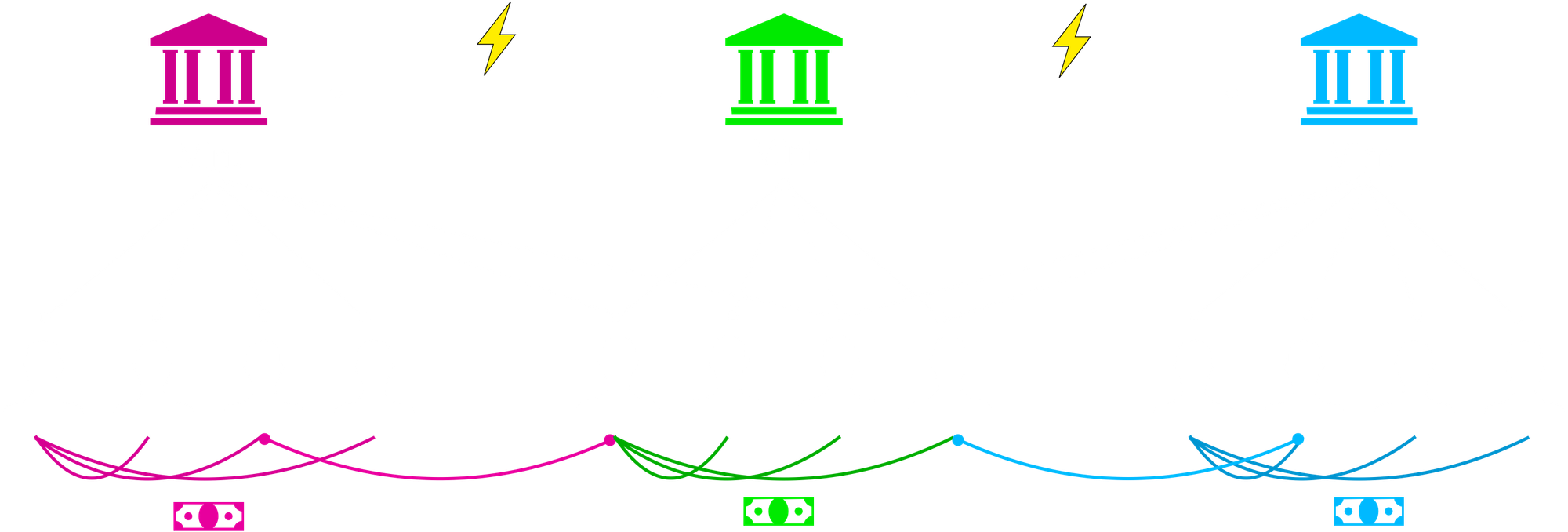

In practice, this compromise means that, today, most Bitcoin use for small amounts that can cover everyday purchases such as a cup of coffee is handled by third-party intermediaries, so-called custodial systems. Custodial wallets hold users' funds for them and allow users to share the burden of running infrastructure and paying fees by trusting a centralized third party.

It's important to mention that Bitcoin works reasonably well for cases in which someone wants to store their wealth and have a relatively large amount that they rarely need to move around. However, when you buy a newspaper, buy a subscription, donate to a good cause, or simply enjoy your coffee, data indicates that the vast majority of users still prefer custodial wallets for small amounts over on-chain transactions or even running a Lightning node themselves.

This is a two-fold issue. The first issue is very obvious: if you trust a third party with your funds, they can run away with it. Custodial systems are not rug-resistant. The second issue though, arguably in many cases even more important than the first one, has to do with privacy. Every custodial system today works the same way as the good old Excel sheet that's based on thousands-of-years-old technology: a simple transparent ledger, recording every user's activity.

But wait. Does this ring a bell? It's almost like David Chaum predicted all of this but for the fiat banking system. And he had a solution to it, remember?

So, we asked a simple question: What would an Ecash system look like if it were built for the new money—the money of the internet? What would an Ecash system look like that's built for Bitcoin?

What would it look like if there was a way for merchants, social media protocols, music and video streaming services, community banks, and all other financial services to provide a safe, privacy-preserving alternative to the old account-based model—built on Bitcoin?

What would it look like if a user of a custodial wallet, or a VPN provider, or a payroll system, could withdraw digital bearer tokens to their phone, and send them to their friends without being tracked by the service provider?

What would it look like if the service provider wouldn't have to handle toxic personal user data, and make sure to keep it secure from hackers and other threats that could wipe out—or worse—leak some of the most intimate information about their users to the whole world?

It would look like a world with many independent local services all connected to each other in a network via the money of the internet.

Help us build this world and restore privacy for our most intimate online behaviors. Help us design a safe system with responsible priorities that defends users' rights. Help us make sure that Ecash technology remains free and open-source so that everyone in this world can have equal access to these systems and can choose what's best for them.

Join us.

Learn more on cashu.space